In this Revolut review, we’re going to look at one of the most popular travel cards and banking apps. Since its foundation in 2015, Revolut has built up a loyal userbase and to some extent has changed the game when it comes to exchanging and spending money abroad. We’ll have a look at whether it lives up to the hype and whether there are any disadvantages you need to be aware of.

Table of Contents

- Revolut Review – Is it the best travel card & banking app?

- Revolut Review – Pros & Cons for Travellers

Revolut Review – Is it the best travel card & banking app?

What is Revolut?

Founded in 2015, Revolut is a financial company based in the UK but operating globally. While by most definitions it is not technically a bank, it offers banking services via its mobile app and enables users to hold balances in many different currencies and exchange money at market-leading rates. By carrying a Revolut card, you can withdraw money, send money and pay for things in foreign countries via card in the local currency, thus removing or cutting most foreign transaction fees.

It offers a number of other services too with trading stocks and cryptocurrencies also possible via the app. However, for the purposes of this Revolut card review, we are going to focus purely on how useful it is for travellers whether that’s for a short weekend break abroad or a long backpacking trip in multiple countries. We’ll assess how it stacks up against the best “no-fee” debit cards for travellers.

Revolut Sign Up Offer

If you haven’t previously used Revolut, you can claim your first Revolut card for free. It’s pretty simple to get going provided you have a smartphone and all you really need is a phone number and an address where you can get the card sent to.

While you wait for your card to arrive, you can start to familiarise yourself with the app and set things up. There are a few security checks you need to go through but before long you’ll be able to add funds to your account directly from your bank (in your local currency). This is usually instantaneous and you can then easily exchange money into a host of other currencies.

Your account also includes the option for a virtual card which you can use for online purchases so it’s possible to start buying things even before your physical card arrives. You can also link that virtual card with digital wallets like Apple Pay and Google Pay.

Is Revolut really free?

Getting started on Revolut is totally free. If you lose your initial free Revolut card or want another, you’ll have to pay £4.99 for a new one. For most travellers, the Standard free plan will be totally fine for your usage needs. However there are also paid plans costing between £2.99 and £12.99 per month which include a range of extra services including insurance, higher withdrawal limits and trading perks. You can always upgrade later if you start to use Revolut regularly and decide it is the banking app for you.

In terms of exchanging money, for up to £1000 per month, there are no exchange fees for almost all major global currencies from Monday to Friday (UK time), although there is a 1% fee on weekend transactions. This can be avoided pretty simply by only exchanging money via the app during the week. If you need to exchange more than £1000 per month, you’ll be subject to a 0.5% fee but this can be avoided by signing up to one of the paid plans.

When it comes to withdrawing money, only the equivalent of £200 per month or the first five withdrawals are free. After that, you’ll have to pay 2% when withdrawing money which makes it a less appealing option if you’re travelling to any countries that still have mostly cash-based spending cultures, although it’ll still most likely prove better value than using your regular debit card.

It’s also worth noting that a Revolut card isn’t some magic device that protects you from all banking fees. Local banks may still add on fees when withdrawing money from their ATM’s but this will be the case regardless of which bank or travel card you use.

Revolut Review – Pros & Cons for Travellers

What are the advantages of using Revolut whilst you travel?

- Excellent exchange rates

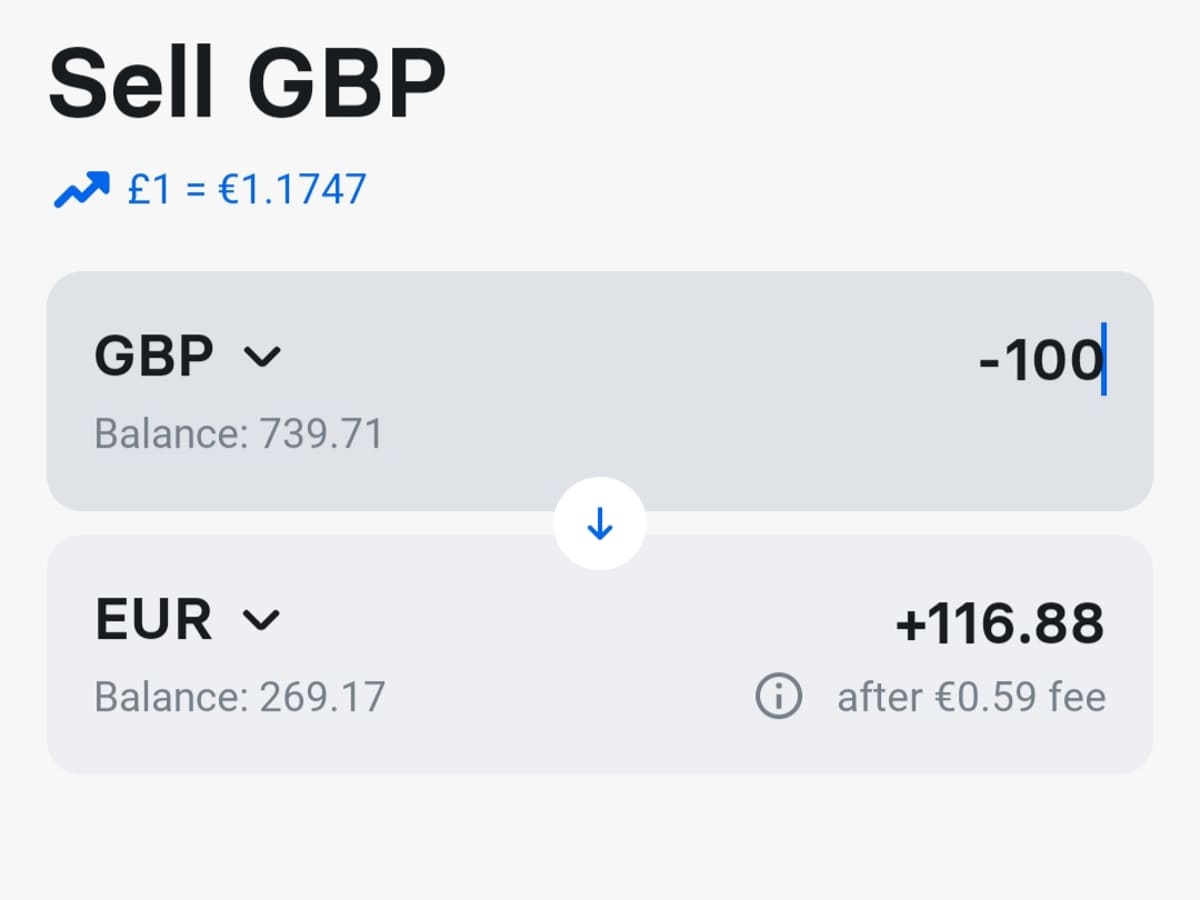

Perhaps Revolut’s biggest advantage is its ability to offer near-perfect interbank exchange rates which you will simply struggle to beat. It’s simplest to just exchange money in the app and then any foreign purchases you make will come out of the equivalent currency’s balance. If you don’t hold a balance, then Revolut will still automatically make the conversion for any payments using the best available rate provided by financial exchanges which is a significant advantage on traditional banks that set their own rates and often also charge high foreign transaction fees.

Not only are the rates great, but it’s really easy to exchange money with just a click of the button from your mobile.

- Transparency

A big part of Revolut’s plans to shake up the game when it comes to banking and travel, is they aim to offer greater transparency. As previously mentioned, it’s quite easy to avoid fees altogether by only exchanging money during the week and staying within the £1000 fair usage limit. However, should anything you do on the app incur a fee, this is clearly outlined before anything is confirmed and you can read about it to understand why you are paying a fee.

- Security

The security aspect of Revolut is also impressive. While the initial checks and set-up can be a bit of a pain, once that’s out the way, you will have a really smart and secure banking app. You can sign in using your fingerprint and what’s really useful from a travel perspective is the ability to freeze and unfreeze any of your cards with the click of a button.

Should you be unfortunate enough to lose your card or be the victim of a theft, there’s no need for long and expensive international calls to your bank as you try frantically to remember the answers to your various security questions. Instead you can just sign in to the Revolut app and press freeze in an instant. Find it later, and you can unfreeze it and continue using it as normal.

There’s also nothing to stop you ordering two cards before you leave home and taking them both with you on your travels. Therefore if you lose one, you should have the other as a fallback providing you store it in a different place.

- Keep tabs of your spending

Another positive is the ease with which you can review your spending in real time via the Revolut travel app. You will receive instant notifications any time you make a purchase which will enable you to spot if you have been overcharged for something. You can also monitor your travel budget and set spending goals which can be a useful tool for anyone on a longer backpacking trip for example.

- Split bills & send/receive money easily

If you’re travelling with friends, then first you need to encourage them to get a Revolut card and there are cash incentives for doing that via the Revolut referral links in the app. If your travel companions are on Revolut, you can then use the app to easily split bills and send money to each other in an instant in the currency of your choice. Your Revolut account links your mobile number so sending money to a friend is as easy as sending a message.

What are the disadvantages of a Revolut card for travel?

- Customer support isn’t great

Part of the appeal to Revolut seems to be that anything and everything can be done via the app without any need to have a conversation with anyone. That’s great in theory and it’s true that most issues can be fixed with the click of a few buttons. However should you have any need to get in touch with a real human being, you may be disappointed by their customer support.

There is an unreliable chat function via the app but should you lose your phone or find yourself locked out of your account for any reason, then it can be a frustrating experience trying to get everything sorted. There are even some customers who have reported being left without access to their money for long periods having been locked out.

- Will you have internet access abroad?

The app works best when you have an active data connection and aren’t reliant on logging in to wifi. Without internet access, you won’t be able to track your purchases in real time or send money to friends or travel companions and split bills. That won’t stop you being able to use your card but there are sometimes circumstances where you get close to transaction limits and have to confirm via the app that you are still in control of your account. That doesn’t take more than a couple of seconds normally but it won’t be possible if you’re not connected.

- Controversies

Revolut has come a hell of a long way in a short time. Having started as a small project in 2015, it has become one of the world’s largest challenger banks valued at a whopping $33bn in 2021, making it Britain’s most valuable private company. Like most companies that grow so quickly, there have been a few bumps along the road and you won’t struggle to find online reports on why Revolut is bad.

Some employees in the past have spoken of a toxic working environment and there have been stories where customers have complained of missing funds. In truth, you can find comparable tales at most major banks and financial companies and the signs are that Revolut have largely reacted to and rectified such problems. However it certainly doesn’t help their image and claims to be this shiny new thing that operates in a much more ethical and positive way than traditional banks.

Conclusion – Should you use Revolut for your next trip?

Overall, anyone who is still using their regular old bank card to withdraw money and pay for things, will almost certainly benefit from switching to Revolut. Put simply, it will cut fees and save you money and potentially lots of it if you are somebody who does a lot of travelling. Most Revolut travel card fees are easy to avoid by doing basic things like avoiding weekend exchanges and monitoring your withdrawals and spending habits.

Regarding some of the disadvantages mentioned at the end of this Revolut travel card review, there are also precautions you can take to try and ensure your experience is a positive one. Not losing and taking care of your phone is a good starting point! However it’s also wise to understand what the process is for getting access back to your account should the worst happen. Be sure to travel with or have online access to anything you may need to complete this process.

Unless you are really unfortunate, there shouldn’t really be any other reason why you would need to contact support. Ensuring you have a suitable sim with data in the country you are visiting will help everything go more smoothly but it’s not absolutely essential.

You’ve not really got anything to lose by signing up to Revolut and getting your free card and even if you’ve still got doubts you can, and probably should, always travel with both a Revolut card and cash or alternative debit/credit card.

There are also now other challenger banks and apps that offer very similar services to Revolut but as one of the most established and most popular, it’s as good a bet as any with very little to differentiate these companies in terms of the limited fees they charge. On a practical level, there’s also perhaps more chance of your current or future travel companions being on Revolut than rival services which will make your life easier when it comes to paying for things as a group and sorting out the basics of who owes who.

This Revolut review was written in December 2021. Any fees and other terms mentioned in the post may be subject to change.