Within the UK, there are a wide range of options for travel insurance providers and many now offer packages tailored towards backpackers and longer term travellers. We’re going to take a look at some of the main options for the best backpacker travel insurance for UK residents and see how they compare.

Table of Contents

UK Backpackers – What’s the best travel insurance to get?

One of the decisions travellers will need to make is choosing between a larger international company that offers travel insurance to people from all over the world and one that is UK-based and specifically geared towards Brits.

There are pros and cons to both approaches. International companies are more likely to have expertise in a wide range of countries and local know-how which could prove useful if you need assistance. They will also almost certainly offer 24-7 support to cater for a global userbase whereas British travel insurers may in some cases be harder to reach outside of UK office hours.

However, having that local touch and speaking to somebody from your own country can also be reassuring if you run into problems when abroad. We’ve compared some of the main UK and international companies below to see how they stack up in terms of customer reviews, price and coverage.

Best UK backpacker travel insurance reviews

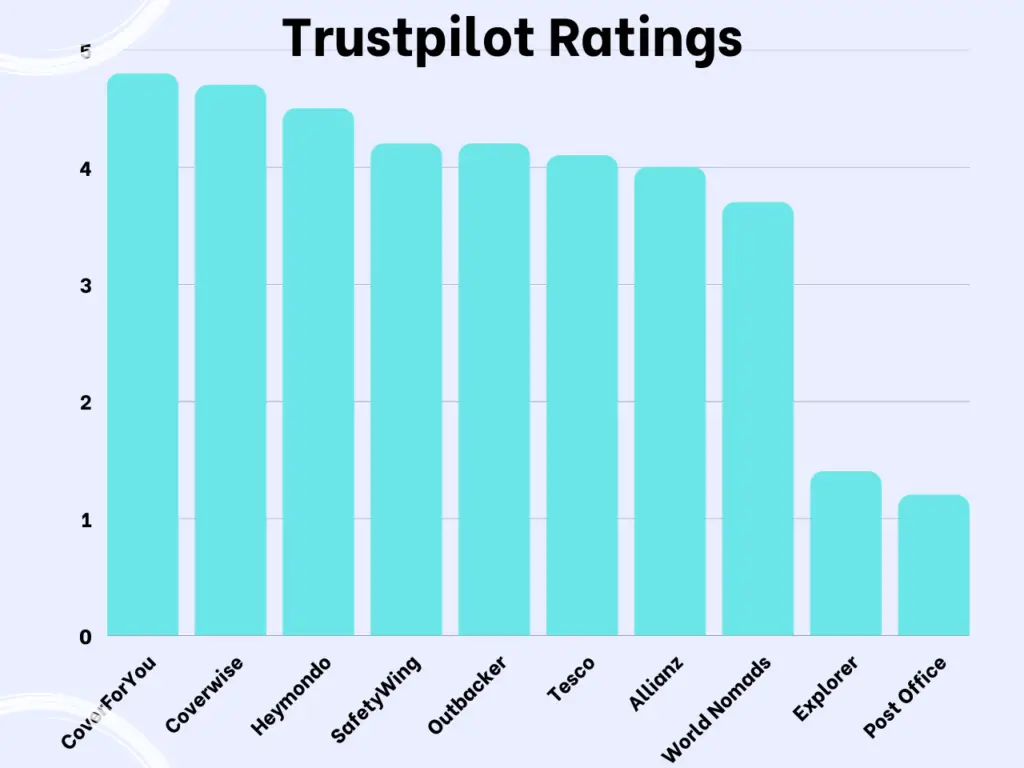

| Insurance Provider | Trustpilot Rating |

| CoverForYou | 4.8 |

| Coverwise | 4.7 |

| Heymondo | 4.5 |

| SafetyWing | 4.2 |

| Outbacker | 4.2 |

| Tesco Bank | 4.1 |

| Allianz Assistance | 4 |

| World Nomads | 3.7 |

| Explorer Travel Insurance | 1.4 |

| Post Office | 1.2 |

We’ve looked at ten of the main options for companies providing travel insurance to UK backpackers. While Trust Pilot reviews don’t always tell the whole story and are more general reviews of the company (some of whom offer many products aside from backpacker travel insurance), they are a pretty good indicator of how customers feel.

Two companies stand out as having exceptionally low ratings. The Post Office attracted a staggering 91% of one-star reviews from a total of 374 ratings. While they do offer other services such as car and pet insurance which affect the rating, customers were far from complimentary about their travel insurance. Explorer Travel Insurance was the other to attract very bad reviews with 93% of users opting for one-star, although it was a much smaller sample size of just 44 ratings.

The other eight companies all attracted mostly positive reviews. The best rated ones were CoverForYou, Coverwise and Heymondo who all achieved scores of 4.5 or more. This points to high customer satisfaction and suggests that those companies all provide excellent assistance.

You can of course find horror stories with just about any travel insurance provider but in all cases, it is really important to understand the full terms of any cover your purchase. No insurance package is totally complete and there may be situations where you have issues abroad that aren’t covered but having suitable insurance can often be a real lifesaver should something go wrong.

Price Comparison

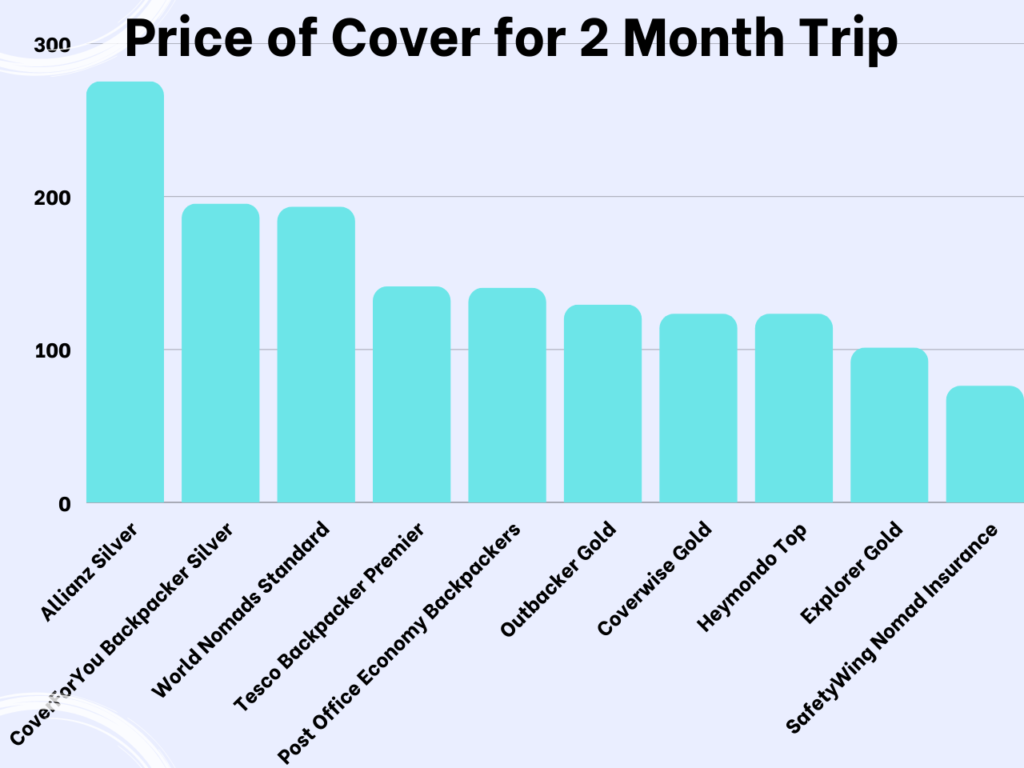

| Insurance Package | Price of cover for a 2 Month Trip in Southeast Asia* |

| CoverForYou Backpacker Silver | £195 |

| Coverwise Gold | £123 |

| Heymondo Top | £123 |

| SafetyWing Nomad Insurance | £76 |

| Outbacker Gold | £129 |

| Tesco Backpacker Insurance Premier | £141 |

| Allianz Assistance Single Trip Silver | £275 |

| World Nomads Standard | £193 |

| Explorer Travel Insurance Gold | £101 |

| Post Office Economy Backpackers | £140 |

The above figures are based on a 22 year old British traveller with no serious underlying health conditions visiting Thailand in August and September 2023. In most cases, it will be the same price for trips anywhere in the world, even visiting many different countries and regions, excluding the US (and in some cases, Canada, Mexico and the Caribbean) which often pushes the prices up.

Standard plans are used in each case without any optional add-ons such as winter sports or riskier activities. However some companies offer various packages and optional additions that allow you to tailor your cover to suit your trip. Currencies were converted to GBP where necessary and rounded up to the nearest pound. Heymondo prices include our 5% Heymondo discount code which is worth using if you opt for them.

At the time of research (July 2023), the cheapest option was SafetyWing Nomad Insurance coming in at just £76. This is primarily medical travel insurance though which means it excludes cover for things like theft and lost electronic items. Some other companies also offer similar slimmed down plans that focus on medical insurance but none were as affordable as SafetyWing.

Explorer was the next cheapest provider of travel insurance to UK backpackers for our trip. Meanwhile Coverwise, Heymondo and Outbacker all had standard plans in the region of £120-130 for two months of travel in Southeast Asia. Allianz Assistance was by some distance the most expensive at £275.

Coverage Comparison

Travel insurance is not something you should automatically just look for the cheapest price and go with that. As with any good or service, there is normally a reason why some providers are more expensive than others and that relates to the extent and amount of cover they offer in the event that something goes wrong.

One thing to look out for is the excess or deductible. This is the amount you’ll have to pay before the balance of any claim is paid out by your travel insurance provider. Of the ones we looked at above, only Heymondo’s Premium plan doesn’t feature any kind of excess, although CoverForYou’s Silver plan features an excess waiver if purchased via their website.

In terms of coverage, all offer medical emergency cover with Coverwise having the largest maximum limit of £20,000,000 for medical expenses. SafetyWing, the cheapest option, has the lowest medical limit of around £194,000. That’s still going to be more than sufficient for almost all medical problems but it also has one of the largest deductibles of around £194 meaning you’ll have to pay for at least the first part of your treatment.

All of those packages provide cover for things like lost checked luggage and travel delays and trip interruption. There will be subtle differences in the terms and situations where you can claim depending on the length of delays and extent of the disruption. That goes well beyond the scope of this article with full T’s & C’s often very long documents in their own right for each insurer but you can quickly get a summary by going to any of their websites and requesting a quote.

One of the bigger differentials is the amount of theft and lost property cover that is provided. This is where more expensive plans such as Allianz Assistance offer much greater protection. For example, Allianz insure you for £500 of personal money if you lose cash or have it stolen while abroad, whereas the other providers have much lower limits such as £200 or don’t cover lost money at all, at least not in their standard plans.

You also want to consider whether you’ll be doing any adventure sports or riskier activities like winter sports, rafting or high altitude hikes. Every insurer will have their own guidelines as to what they consider a “high risk activity” and you should be able to find a full list of excluded sports and activities on their respective websites.

Typically, packages that are more specifically geared towards backpackers such as Tesco backpacker insurance and World Nomads will cover more of these types of activities than a standard travel insurance plan. Heymondo also has options for adding certain sports which is useful if you have a clear idea of what activities you may be doing.

Best Backpacker Travel Insurance UK – Final Thoughts

Of the best international travel insurance companies for backpackers, Heymondo stands out as a good all-round option for those looking for a balance between cheap backpacker travel insurance and decent cover. There are a wide range of plans and ways to tailor your cover to your trip which is important for independent travellers whose needs may not be served by standard travel insurance. They are well liked by customers with an easy to use app and a 24/7 doctor chat function which is very popular with younger travellers who have grown up in the digital age.

Of the other options, Coverwise also stands out for anyone looking for the best travel insurance for backpacking South America, Southeast Asia or other popular regions. They’re a large company with much more positive reviews than some of the other British options such as the Post Office’s backpacker insurance. The price is pretty good too, ranking as the joint 3rd cheapest of the ones we looked at for our trip, with the same price as Heymondo.

Much will depend on you and the type of trip you want to have. If you’re a relatively experienced traveller on a visit to a lower risk country or region in Europe where you won’t be doing many potentially dangerous activities or exposed to any exotic diseases, then a cheaper option like SafetyWing may be adequate. We have a separate SafetyWing review which goes into more detail on them.

However if you’re not experienced at travelling and will be jetting off solo to somewhere tropical and doing lots of activities and things that may carry some risk, you may be wise to look for much more extensive cover. CoverForYou is a nice option for this and includes some extras that you may not find on cheaper deals, particularly if you opt for the Platinum tier.

This overview of the best backpacker travel insurance for UK travellers was published in July 2023. Any terms and prices mentioned are subject to change.