Today, we’re going to take a look at SafetyWing, one of the companies that can claim to offer the best travel insurance for digital nomads. In this SafetyWing nomad insurance review, we’ll assess what is and isn’t covered and whether they are a good choice for anyone travelling around the world while working remotely.

Table of Contents

- SafetyWing Nomad Insurance Review

- Who are they?

- What is nomad insurance?

- SafetyWing Insurance – The Basics

- SafetyWing Insurance for Nomads – What is covered?

- What isn’t covered?

- How much does SafetyWing’s Nomad Insurance cost?

- SafetyWing FAQ’s

- Does SafetyWing have a deductible (AKA excess)?

- Does SafetyWing cover Covid?

- SafetyWing vs World Nomads – Which is better?

- I have an EHIC, do I still need insurance for travel in Europe?

- Can I purchase SafetyWing if I’m already abroad?

- Does it cover home visits?

- Who can use SafetyWing?

- Is SafetyWing travel insurance good for backpackers?

- Where can you travel?

- How do I make a claim on SafetyWing?

- Conclusion – Does SafetyWing offer the best travel insurance for digital nomads?

SafetyWing Nomad Insurance Review

Who are they?

SafetyWing are providers of international travel medical insurance that is designed specifically for digital nomads.

Essentially they appear to have plugged a gap in the market. Previously digital nomads and remote workers who travelled a lot, simply had to purchase travel insurance like a regular holiday-maker or traveller. However, clearly an active backpacking trip and its associated risks for example, will be quite different when compared to someone spending much of the week working on a laptop from the safety of a coworking space or Airbnb apartment.

As such, SafetyWing have created an affordable insurance package that is tailored towards nomads and remote workers who travel a lot with coverage that is more geared towards that lifestyle.

What is nomad insurance?

Nomad insurance is a combination of travel insurance and medical insurance. Digital nomads will typically be abroad for far longer periods than regular travellers or holidaymakers, therefore it’s possible and perhaps even probable, that at some point they will fall sick while abroad. Having nomad insurance ensures they are covered for medical assistance in the majority of circumstances. Nomad insurance also covers some things that are typically found in regular travel insurance packages. That includes delays, lost checked luggage and personal liability.

SafetyWing Insurance – The Basics

SafetyWing currently offer two main insurance packages. One is called Remote Health which is geared towards startups and companies with a remote workforce in different countries. Unless you are an employer, running a team, this won’t be relevant. Therefore in this SafetyWing insurance review we’ll be focusing on their other package – Insurance for Nomads.

This is described as a “global travel medical insurance” meaning it can be used almost anywhere in the world outside of your home country. Essentially it is medical insurance first and foremost and offers cover should you fall sick or suffer an accident while abroad. In addition, it provides some of the coverage you find on a typical travel insurance package such as support in the case of travel delays and lost luggage.

However the coverage is not quite as extensive as a more typical single-trip holiday insurance package might be for example. You should ideally read through and try to understand the full terms before deciding if it’s the right option for you, but here’s an overview of what is and isn’t covered.

SafetyWing Insurance for Nomads – What is covered?

SafetyWing’s medical coverage includes expenses of up to $250,000, although that reduces to $100,000 if you’re 65 or over. It covers both accidents and falling sick and most associated medical expenses including:

- Hospital room & nursing services

- Intensive care (up to the $250,000 limit)

- Physical therapy and chiropractic care – up to $50/day

- Emergency dental treatment – up to $1000

The travel part of the Insurance for Nomads package covers the following:

- Travel delay – up to $100 a day if you have a 12+ hour delay which requires an unscheduled overnight stay

- Lost checked luggage – Up to $500 per item

- Natural disaster – Up to $100 a day for 5 days (for new accommodation)

- Political evacuation – Up to $10,000 (lifetime)

- Emergency medical evacuation – Up to $100,000 (lifetime)

- Personal liability – Up to $25,000 for 3rd person injury & property (lifetime)

- Accidental death & dismemberment – Up to $12,500 for loss of limb, up to $25,000 in the event of death or multiple lost limbs

Fortunately, many of these points are unlikely to be things you will ever need to worry about. It is though useful to know that you will have coverage in the event of a long delay which causes you to change your travel plans or should your luggage mysteriously go missing due to the failings of an airline or airport.

The medical coverage is also pretty broad and should give you peace of mind that you have cover should you need any sudden medical assistance.

It is though important to note that SafetyWing’s travel insurance includes a $250 deductible. This means you’ll have to pay $250 out of your own pocket if you require treatment and they will cover the rest up to the maximum limit.

What isn’t covered?

There are some notable exceptions that you should be aware of when it comes to the medical insurance though. You won’t be covered if you suffer injuries as the result of playing sport professionally or in a more structured, regular fashion – for example playing for a team with regular practice sessions and games.

There are also a number of “high risk sports activities” which are excluded from coverage in any circumstances. These include a broad range of activities including the likes of white water rafting, American football, ice hockey, parachuting and boxing. You can find a full list of sports that are not covered on page 25 of this document.

You are also not covered for the treatment of pre-existing diseases or injuries or cancer treatment. Likewise routine check-ups are not covered. These are factors to bear in mind, but they are also pretty standard across most travel insurance packages.

On the travel side of things, the main thing to consider is that while there is cover for lost checked luggage, SafetyWing do not cover items that are simply lost in other circumstances or stolen such as electronics. For digital nomads and remote workers who require lots of electronic equipment to do their work or a top of the range laptop, the absence of theft cover in SafetyWing’s nomad insurance package is something to be aware of.

How much does SafetyWing’s Nomad Insurance cost?

| Age | Cost (for 4 weeks) | Cost including US travel (for 4 weeks) |

| 10-39 | $45.08 | $83.44 |

| 40-49 | $73.92 | $137.48 |

| 50-59 | $115.92 | $226.24 |

| 60-69 | $157.36 | $308.84 |

These prices are accurate as of June 2023. As you can see, there are significant price hikes as you get older. It’s also a lot more expensive if you need to travel in the US where healthcare can be ridiculously costly. Again, these factors are standard across almost all travel insurance providers.

If you have a child that is older than 15 days but less than 10 years old, they can be added to the package at no additional cost (maximum of one child per adult). SafetyWing do not insure anyone over the age of 70.

One of the best things about SafetyWing’s Nomad Insurance is the flexibility. You can start with only a 4 week commitment and can easily activate and deactivate it when you need to, a bit like a Netflix subscription!

Therefore it’s a good option for short trips but can also be useful if you are a long-term digital nomad or just basing yourself in a foreign country for a much longer period. You can always deactivate it if you return home, although home visits are covered in some circumstances (detailed below).

SafetyWing FAQ’s

Does SafetyWing have a deductible (AKA excess)?

Yes it does and the amount is $250. Once you have submitted claims of $250 and they are fully approved, you will have met the deductible (paid by you) and any future claims will be paid out in full by SafetyWing if they are covered by the terms.

This is not typical of all insurers but is a big reason why SafetyWing are able to offer cheaper travel insurance packages than the competition.

Does SafetyWing cover Covid?

Yes, they were one of the first insurance providers to do so, first introducing Covid-19 cover in 2020. It is basically treated like any other disease and you will get support as long as you contract it after your insurance starts. They even cover quarantine of $50/day for up to 10 days and the cost of tests if they are deemed a medical necessity.

However you should note that SafetyWing will not pay for you to have tests for the purposes of travel or cover you if the quarantine is mandatory when arriving in a new country for example (i.e. not the result of you having the virus). While these situations are thankfully far less common now in 2023, some countries do still have restrictions and requirements related to Covid.

SafetyWing vs World Nomads – Which is better?

The answer to this will depend on your circumstances. Despite their name, World Nomads offer insurance more geared towards independent travellers and backpackers rather than remote workers and digital nomads. Overall, their cover is typically slightly more extensive but also typically a lot more expensive. However there is no “one size fits all” answer seen as they don’t have a global pricing plan like SafetyWing and provide cover tailored to single trips.

We could write a whole article on this topic in truth but as a very broad overview, it might be fair to say that SafetyWing is a better fit for the needs of most digital nomads. However those who like to indulge in high adrenaline and riskier sports and activities or who are travelling to dangerous countries with higher theft risks, may want to consider World Nomads travel insurance or another company with more extensive cover such as Heymondo (there is also a Heymondo and SafetyWing comparison here which helps to showcase some of the differences between those companies).

Both World Nomads and SafetyWing are most certainly legit companies that have served tens of thousands of travellers. The SafetyWing trust pilot rating is higher though at 4.2 compared to World Nomads’ 3.7 at the time of writing suggesting greater customer satisfaction.

I have an EHIC, do I still need insurance for travel in Europe?

If you are from an EU country, you are entitled to a European Health Insurance Card (EHIC) which gives you access to medically needed, state-provided healthcare in all 27 EU states, as well as the UK, Iceland, Liechtenstein, Norway and Switzerland. In many cases this will be free, however every European country is different and not every one provides free healthcare. An EHIC is not designed to be a substitute for travel or health insurance, but is worth getting if you are eligible (it’s free to get the card!).

Can I purchase SafetyWing if I’m already abroad?

Yes, while it always makes sense to get insured before you leave your own country, you can still sign up to SafetyWing in the normal way even if you’re already abroad.

Does it cover home visits?

There are some circumstances in which you can use your SafetyWing insurance in your own country. You cannot return home for the specific purpose of receiving treatment but if you are visiting home anyway for other reasons and fall ill or get injured, coverage is provided as long as you have previously spent at least 90 days abroad. In that case, you’re covered for brief visits back home for up to 30 days (15 days for US residents).

Who can use SafetyWing?

As long as you are under 70 years old and your home country is not Cuba, Iran, Syria, or North Korea, you should be able to purchase SafetyWing’s nomad insurance.

Is SafetyWing travel insurance good for backpackers?

This will depend on the nature of your trip, where you are going and what activities you plan to do. Seen as backpacking trips typically involve greater risks of theft and may involve activities that are more likely to cause injury, SafetyWing may not be one of the very best travel insurance options for backpackers.

However if you’re confident you won’t be playing or doing any of the excluded sports and activities, SafetyWing can still be a good, cheap option for backpackers. You’ll still be covered for falling sick and typical mishaps on backpacking trips like lost checked luggage and long delays, not to mention more serious situations like dealing with natural disasters and political events that require evacuation.

You’ll want to take really good care of your belongings though as you won’t be covered if they are stolen or lost in a hostel for example. The risks attached with a long trip backpacking around South America is one situation where SafetyWing may not be the ideal solution for backpackers.

Where can you travel?

SafetyWing will cover you in almost every country in the world, whether you’re in digital nomad hotspots like Portugal or Thailand, or somewhere far more off the beaten path. The only exceptions are countries/regions that are subject to US, UK, EU and UN sanctions like North Korea and Iran.

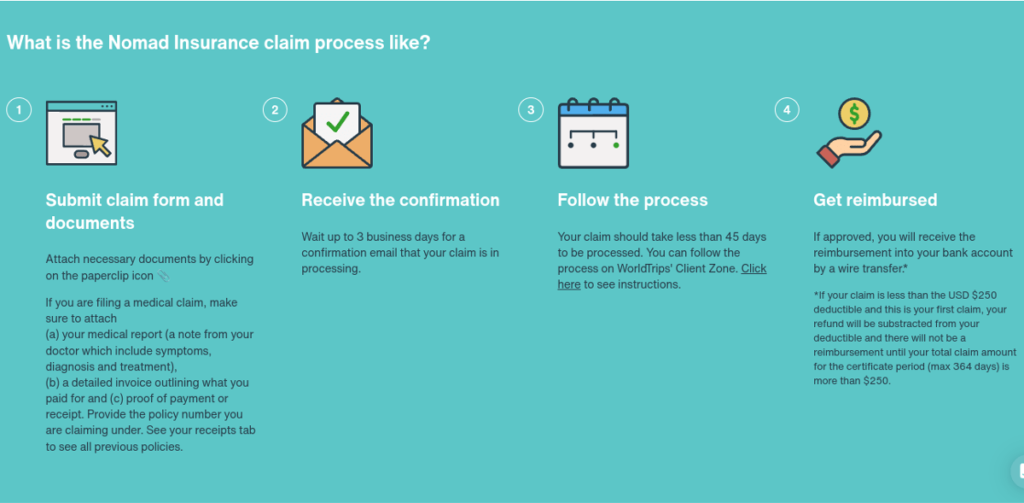

How do I make a claim on SafetyWing?

Head to the claims page to begin the process. You will need to fill out a form, submit supporting documents such as medical reports and then wait for your claim to be processed. If successful, you’ll be reimbursed directly into your bank account unless your claim is for less than the $250 deductible.

Note that emergency assistance is also available via 24/7 phone lines should you require immediate help or have questions about submitting your claim.

Conclusion – Does SafetyWing offer the best travel insurance for digital nomads?

Overall it certainly feels like SafetyWing lead the way with the best travel insurance for nomads around the world. It’s extremely flexible, easy to sign up for even if you’re already on the road and easy to cancel with no long-term commitments needed. SafetyWing’s package is also really good value, particularly if you’re under 40 and don’t need cover for the US.

Perhaps the most important point though is that they are a team of digital nomads based in many different countries and continents. Therefore they should be genuine specialists in covering nomads with experience of dealing with the kinds of problems they may run into. Should you need to use their 24/7 support, you can be sure you’ll be in touch with someone who understands your situation and lifestyle which is rarely the case with other travel insurance providers, none of whom truly specialise in digital nomad insurance in the way SafetyWing does.

That all being said, it is important to understand the limitations of SafetyWing’s coverage. When it comes to the best health insurance for digital nomads, they’re a really strong option but only as long as you’re not doing any particularly risky sports and activities on a regular basis.

Other providers also certainly have more extensive coverage when it comes to theft and lost possessions so those with more expensive items that are essential for work and go beyond the standard mobile phone and laptop, may want to assess other options. That’s certainly true if you’ll be heading to a country or region which is considered more dangerous and where foreigners are likely to be a target for thieves.

You can get a quote in less than a minute here to find out how much SafetyWing’s nomad insurance would cost in your circumstances.

This SafetyWing travel insurance review was published in June 2023. All terms are subject to change as time goes by so double check everything at the time of purchase.